In recent developments, alarming videos have surfaced online, exposing misconduct by officers at Bandhan Bank and Canara Bank, shedding light on the intense pressure faced by junior employees to meet targets.

Unprofessional Behavior Exposed Bandhan Bank officer

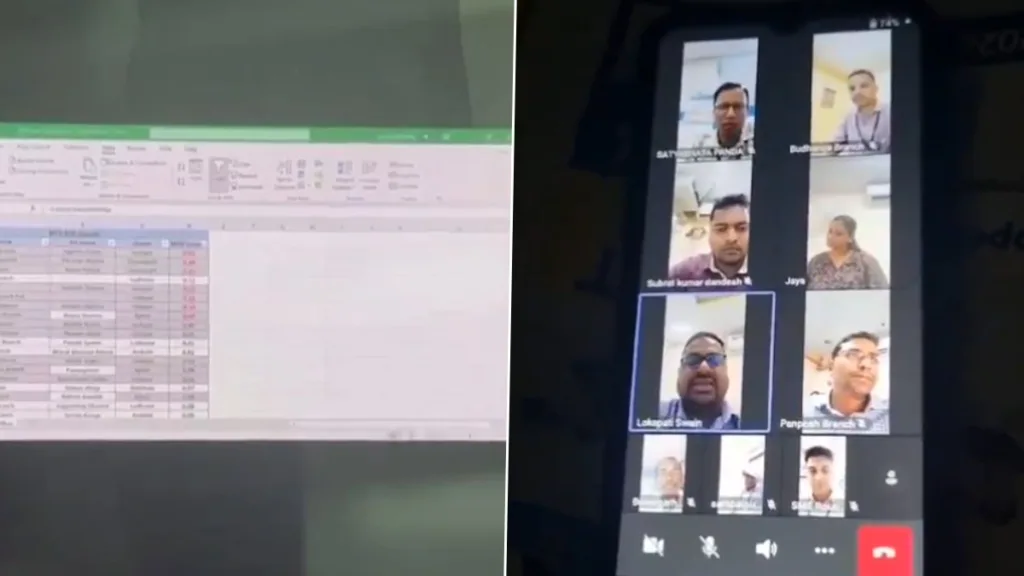

The videos depict instances of aggressive behavior, including the use of foul language and intimidation tactics by senior officers towards their subordinates for failing to meet performance targets. In one incident captured on April 24, a Bandhan Bank officer, identified as Kunal Bhardwaj, is seen berating a junior employee during an online meeting, questioning their commitment to meeting targets for the month.

Similarly, another video emerged on May 4, featuring Canara Bank officer Lokapati Swain, who pressured employees to prioritize work over personal time, including sacrificing family holidays. The videos have sparked outrage on social media platforms, with users condemning the lack of work-life balance and professionalism exhibited by the bank officials.

Bank Responses and Regulatory Caution

Following the circulation of these videos, both Bandhan Bank and Canara Bank released statements condemning the behavior depicted in the footage. Bandhan Bank emphasized its commitment to values and initiated necessary actions against the involved personnel, while Canara Bank reiterated its stance against such behavior and assured appropriate action.

This incident underscores a broader issue within the banking sector, where employees face unrealistic performance targets, often resorting to unethical practices to meet them. Concerns over such practices prompted the Reserve Bank of India (RBI) to convene meetings with the boards of directors of both public sector and private banks in May 2023 to address governance and ethics concerns.

The finance ministry has also directed public sector banks to implement robust mechanisms to prevent unethical practices, particularly in the sale of financial products such as insurance policies. Complaints received by the Department of Financial Services highlight the need for stricter regulations to curb fraudulent and unethical practices within the banking and insurance sectors.